Language

Javascript

Tool Type

Algorithm

License

Apache License, Version 2.0

Version

12.0.2

MojaLoop

Mojaloop facilitates the creation of interoperable payment platforms, connecting financial providers and customers, especially those excluded from the banking system. Acting more as a reference model than a financial application, Mojaloop seeks to remove barriers of time, cost and technical complexity, addressing the needs of the world's 1.7 billion unbanked people. Designed for payments interoperability, it offers a path to expand digital financial services. Mojaloop's focus is to enable organizations to build digital payment systems that promote financial accessibility. Using Mojaloop Foundation software, entities can create platforms that facilitate seamless transactions between a wide range of actors, including users, banks, governments, and more, effectively integrating underserved populations into the digital economy. This marks a significant step towards broader financial inclusion.

Mojaloop solves the challenge of integrating unbanked people into the digital economy by facilitating the creation of interoperable payment platforms. This reference model eliminates barriers, allowing the expansion of digital financial services to the unbanked. Improves financial accessibility and promotes inclusion.

Financial Inclusivity: Connects multiple Digital Financial Services Providers to create a competitive, interoperable network for financial services. Centralized Hub: Provides a central hub for financial transactions, ensuring efficient and equitable money flow similar to a central bank. Open Access: Designed to prevent monopolistic control and promote the inclusion of new entrants in the financial market. Fraud Mitigation: Includes mechanisms for identity lookup and fraud management to maintain system integrity.

Provides open-source specifications and software, facilitating interoperability among financial service providers. Offers detailed documentation and guides that adhere to open standards, ensuring clear development guidelines. Encourages community participation through forums and discussion channels, promoting collaboration. Utilizes GitHub and Zenhub for version control and project management, adopting open standards. Implements Kubernetes for deployments, ensuring modularity and scalability.

Connect with the Development Code team and discover how our carefully curated open source tools can support your institution in Latin America and the Caribbean. Contact us to explore solutions, resolve implementation issues, share reuse successes or present a new tool. Write to [email protected]

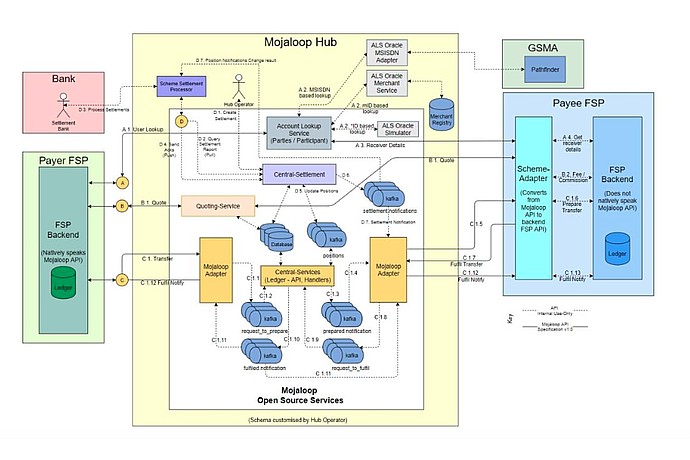

Mojaloop flowchart showing interaction between Payer FSP, Mojaloop Hub, Payee FSP, and Bank, with services like Quoting-Service and Central-Services. Includes Kafka connections and API processes.

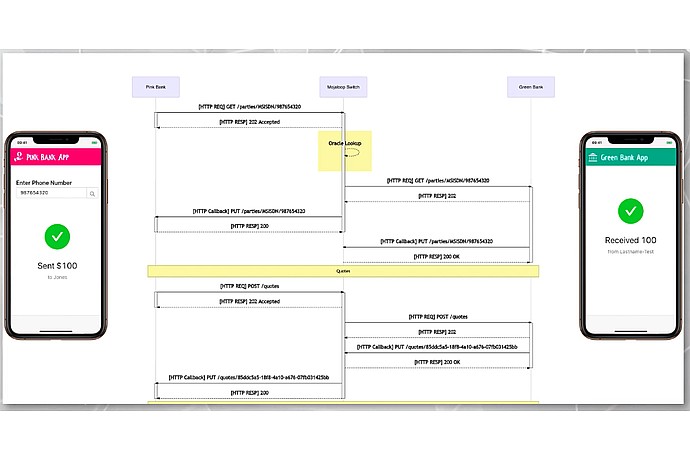

Mojaloop sequence diagram: displays transactions between "Pink Bank" and "Green Bank". Includes HTTP requests for verification and transfer, and confirms sending $100 via mobile interfaces.

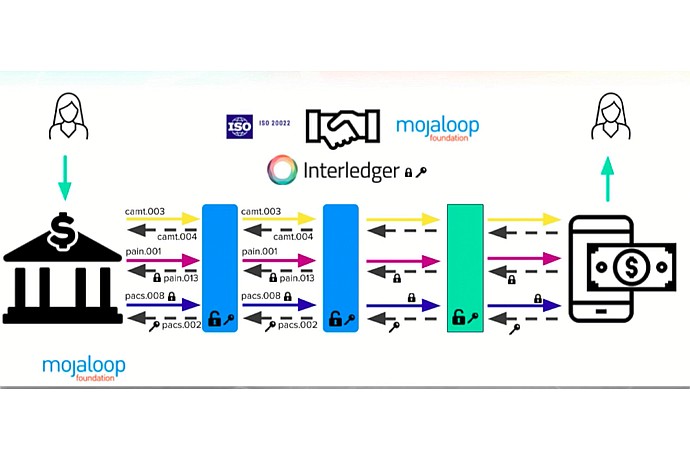

This image showcases the interoperability of financial transactions using the Mojaloop platform, which leverages the Interledger protocol for standardized message formats like ISO 20022.

Open source software that serves as a reference model for creating interoperable payment platforms.

Official list of open source tools endorsed by the Digital Public Goods Alliance. This tool is part of this registry.

Article that presents the global alliance to promote digital public goods and its relationship with the IDB.

Explaining how Mojaloop is expanding financial inclusion through digital payment platforms.